Residential Property Tax Spike in El Paso County Outpaces Commercial Increases for 2025

O'Connor discusses how residential property taxes are spiking in El Paso County and outpacing commercial increases for 2025.

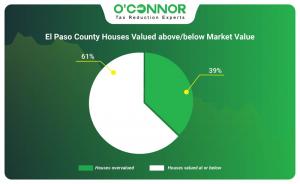

EL PASO, TX, UNITED STATES, May 22, 2025 /EINPresswire.com/ -- The El Paso Central Appraisal District has released its proposed property tax valuations for 2025. In the latest reassessment, approximately 39% of residential properties in El Paso County were overvalued, while 61% were assessed at or below market value. Although the majority of homes fall within fair valuation, a significant portion of 39% are facing inflated or potentially unfair tax assessments. Residential property values rose sharply in 2025, with an overall increase of 5.8%, outpacing the growth in commercial property values. While only 1.4% of commercial properties experienced steep valuation hikes, those affected are bearing a disproportionate burden from these increases.

Homeowners Face Higher Assessments as El Paso County Values Climb 5.8%

An analysis of property tax assessments by value range in El Paso County shows that value assessments increased in similar values for all categories. The market value from 2024 to 2025 rose from $53.4 billion to $56.6 billion. The largest value increase was seen in houses valued between $500 thousand to $750 thousand by 6.5% with a 2025 notice market value of $3.4 billion. Another noteworthy increase was seen in houses valued between $1 million to $1.5 million with 6.1%, rising from $635 million to $674 million.

In El Paso County, property assessments increased across all home size categories, with similar percentage gains. Surprisingly, the largest jump of 6.3% was seen in homes measuring 2,000 square feet or less, with total assessed value rising from $32 billion to $33.5 billion. Two other categories – homes between 2,000 and 3,999 square feet, and those 8,000 square feet or larger – each saw a 5.1% increase in value.

According to El Paso CAD, most homes according to year built faced high increases in assessment values for 2025. The greatest increase was seen in contemporary homes built in 2021 and above with 31.3%, rising from $3 billion to $4.1 billion. This high increase is interesting considering that homes built between 2001 to 2020 experienced the lowest value increase of 2.0%. Another interesting take is that according to the graph, older homes also saw high percentage increases in value assessments for 2025. For example, homes built before 1960 increased greatly by 6.8% with a 2025 notice market value of $8.5 billion.

39% of Homeowners are Experiencing Steep Value Increases in 2025

According to the latest reassessment, approximately 39% of residential properties in El Paso County were assessed above their market value, while 61% were valued at or below market. This indicates a positive trend toward more accurate valuations overall. However, the fact that 39% homes remain overvalued highlights a continuing concern for a substantial portion of homeowners who may be subject to inflated or inequitable property tax burdens.

Value Assessments for Commercial Property in El Paso County Rose by 1.4%

An analysis of commercial property tax assessments in El Paso County by value range shows a revealing correlation. The more expensive the commercial property is, the lower the value increases. Instead, older commercial property ($500k and less) had the highest value increase of 5.9% with a 2025 notice market value of $1.3 billion. On the other hand, more high-value commercial property, for example those valued between $1 million to $5 million, increased slightly by 1.9%. Commercial property valued at $5 million or more actually experienced a decline by 0.8%, dropping from $4.64 billion to $4.61 billion.

For the 2025 tax year, El Paso CAD raised the market values across three categories of commercial properties, while some properties saw declines in value. The three increases in ascending order were seen in hotels by 2.1%, offices by 9.3%, and the largest, land by 14.1%. The following properties saw a decline in assessment value: apartments by 4.2%, retail property by 0.2%, and warehouses by 0.8%.

Commercial property assessments for 2025 by the El Paso CAD increased across three construction years, while the other three saw declines. The highest increase was seen in commercial property built in 2021 and later by 29.3%, rising from $579 million to $749 million. Th biggest decline was seen in commercial property constructed between 1981 to 2000 with 2.9%, falling from $2.42 billion to $2.5 million.

Incongruity Between Appraised Property Values and Market Performance

The 2025 commercial property tax reassessment released by the El Paso Central Appraisal District (CAD) stands in sharp contrast to national market trends identified by Green Street Real Estate Advisors, a respected Wall Street firm specializing in commercial real estate analysis. According to Green Street, commercial property values have declined approximately 21% from their peak in 2022, reflecting a nationwide cooling of the commercial real estate market amid rising interest rates.

However, El Paso CAD’s data tells a different story at the local level, reporting a 1.4% increase in commercial property values over the past year. This contrast raises questions about how local assessments are being calculated and whether they accurately reflect real market conditions. The discrepancy could mean that many El Paso commercial property owners are being taxed based on values that may not align with market trends, potentially leading to overvaluation and increased tax burdens.

Apartment Buildings in 2025 Faced a Decline of 4.2%

The graph shows a mixed correlation between the year an apartment was built and the percentage increase in property tax assessments in Travis County for 2025. While high-value apartment buildings increased in value, other apartment buildings declined in value. Newer apartments built in 2021 and later increased in value by 43.5%, rising from $147 million in 2024 to $211 million in 2025. The greatest decline was seen in older apartment buildings built between 1981 to 2000 by 14.1%, dropping from $834 million in 2024 to $716 million in 2025.

Apartment owners in El Paso County by sub-type faced a major decline in value. Apartment gardens – the only subtype in the county – declined by 4.2%, from $3.4 billion to $3.3 billion in the last year.

Modern Office Buildings are Experiencing Greater Increases in 2025

According to El Paso CAD, property tax assessments for office buildings in 2025 have increased across all construction years, especially for newer builds. The highest increase was seen in offices built in 2021 and later with 14.9% and a 2025 notice market value of $87 million. In contrast, a slight increase was seen in office built before 1960 with 5.0%. The overall market value from 2024 to 2025 increased by 9.3%.

In 2025, property tax assessments for both medical and general office buildings in El Paso County saw increases. Medical office buildings experienced the most significant rise, with valuations increasing by 24.8%. In comparison, general office buildings saw a more modest increase of 2.5%. The market value for medical offices in the past year grew from $499 million to $622 million.

Retail Properties Face a Decline in Market Value

Property tax assessments for retail buildings in El Paso County encountered many declines except for two categories: retails property built before 1960 and those built in 2021 and later. Modern retail property built in 2021 and later saw a 32.8% increase in value, rising from $74 million to $98 million. The greatest decline was seen in retail property built between 2001 to 2020 by 4.0%, dropping from $724 million to $695 million.

For retail property by sub-type, property owners experienced declines with minimal increases in value. The greatest increase was seen in retail stores with 4.1% and a 2025 notice market value of $249 million. Surprisingly, the biggest drop in value was seen in shopping centers by 5.5%, falling from $266 million to $252 million.

Warehouse Tax Assessments Face a Decline in 2025

In El Paso County, warehouse property overall faced a decline in value assessments by 0.8%. Three categories of warehouse property according to year-built experienced an increase in value. Warehouses built in 2021 and later saw the greatest increase of 4.1%, followed by those built before 1960 with 1.7%. The greatest decline belongs to warehouses built between 2001 to 2020 with 4.8%, decreasing from $412 million to $392 million.

El Paso CAD determined the market values of two categories of warehouse properties: mini and regular warehouses. Regular warehouses decreased in value by 1.4%, while mini warehouses increased in value by 1.5%.

Over the past year, the El Paso Central Appraisal District (CAD) increased residential property valuations by 5.8%. In contrast, actual home prices in the El Paso metropolitan area rose by just 2.1% during the same period. This discrepancy suggests that appraisal values are outpacing real market trends, potentially leading to inflated property tax bills for homeowners. The gap between assessed and market values highlights the importance of reviewing appraisal notices closely and considering an appeal if the assessed value appears inconsistent with current market conditions.

Summary for Travis CAD 2025 Property Tax Revaluation

The 2025 property tax reassessment in El Paso County reveals both progress and ongoing concerns. While 61% of residential properties were assessed at or below market value, a significant 39% remain overvalued, highlighting continued challenges for many homeowners. Residential property values saw a notable 5.8% increase, surpassing the modest 1.4% rise in commercial property assessments. However, for the small share of commercial property owners who experienced substantial increases, the financial impact is considerable. These findings underscore the importance of reviewing property assessments carefully and exercising the right to appeal when valuations appear inaccurate or excessive.

Appeal Your Property Values Each and Every Year

If you own property in Texas, including El Paso County, you have the legal right to challenge your property tax assessment. Whether it’s a home or a commercial building, appealing your valuation gives you the chance to present evidence that your property has been overassessed and potentially save thousands in taxes. In fact, the majority of property tax protests result in a reduction, making it a smart move for most property owners. Partnering with a seasoned property tax consulting firm can maximize your chances of success. With nearly 50 years of experience, O’Connor has helped countless Texans reduce their property tax burdens using proven, cost-effective strategies. Don’t leave money on the table, let O’Connor fight for the fair value of your property.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release