Outsource Accounts Payable Services Fuel Innovation in Business Finance Across the USA

Outsourced AP services by IBN Technologies streamline payments, cut costs, and improve financial control for U.S. businesses.

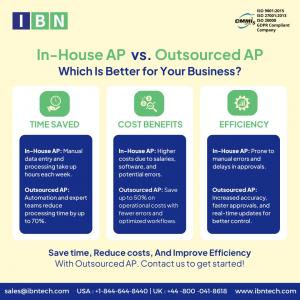

MIAMI, FL, UNITED STATES, June 5, 2025 /EINPresswire.com/ -- Outsourced accounts payable services are becoming more popular in the United States as businesses look for ways to cut costs and improve efficiency. Companies in the industrial, technology, healthcare, and retail sectors depend on outside suppliers to handle vendor payments and simplify financial processes. This change is motivated by the need to lessen the strain of manual processing, adjust to distant work patterns, and maintain regulatory compliance. Companies of all sizes may benefit from outsource accounts payable services as they enable them to reduce expenses, hire qualified experts, and reallocate internal resources to essential company operations.In addition to operational assistance, these services provide improved cash flow and financial obligation visibility, which facilitates more informed decision-making and improved budgetary management. Standardized processes and real-time data enable businesses to detect problems early and keep their payables process accurate. Companies like IBN Technologies contribute dependable processing systems and industry-specific expertise that guarantee on-time payments and foster enduring vendor relationships. Businesses who collaborate with these partners experience more control and trust in their financial management in addition to increased efficiency.

Streamline your AP process—book your free consultation now!

Schedule a free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Managing Payables in a Demanding Ecosystem

Ineffective payables operations and disjointed financial systems are becoming a bigger problem for American firms. Internal teams frequently find it difficult to keep up when regulatory scrutiny increases and vendor expectations for on-time payments climb. Leadership is calling for increased precision, responsibility, and consistency in their financial processes because of this mounting pressure.

Common issues that frequently impact performance include:

• Disconnected or manual invoice handling

• Missed early-payment opportunities and frequent delays

• High costs from outdated, paper-based processes

• Limited visibility into pending obligations

• Increased risk of non-compliance with changing regulations

• Strained vendor relationships due to inconsistent payment cycles

• Challenges in unifying payables across multiple departments or entities

These challenges often result in poor cash flow management, audit risks, and weakened supplier confidence. To address these concerns, many companies are engaging external providers to manage their payables more effectively. Firms like IBN Technologies provide customized accounts payable outsource providers management solutions, combining structured processes with expert support. This approach helps businesses take control of their financial obligations, improve operational efficiency, and maintain strong vendor partnerships.

Optimizing Accounts Payable Efficiency Through Outsourcing

Outsource Accounts Payable Services enables businesses to improve their financial operations by emphasizing accuracy, efficiency, and regulatory compliance. Collaborating with experienced accounts payable solutions providers allows organizations to simplify their processes and boost overall performance. Key services typically included in outsourced accounts payable solutions are:

✅ Efficient accounts payable invoice processing from receipt through payment to ensure timely and accurate processing

✅ Clear vendor record keeping and effective communication to support smooth transactions and prompt payments

✅ Monitoring and controlling business expenses to optimize cash flow and minimize unnecessary costs

✅ Handling payment execution in full compliance with contracts to avoid late fees

✅ Regular account reconciliation to confirm accuracy and adherence to financial regulations

✅ Comprehensive reporting and analytics to track accounts payable performance, analyze spending trends, and support informed decision-making

To assist organizations better manage their financial operations, IBN Technologies provides outsource accounts payable services. While guaranteeing accuracy and efficiency in payment processing, businesses may focus on their core competencies by assigning AP chores to others. In addition to promoting better cash flow management and regulatory compliance, this approach reduces operating costs and offers a comprehensive and effective accounts payable management solution.

IBN Technologies’ Outsourced Accounts Payable Services: Key Benefits

Outsourcing accounts payable helps businesses simplify finances, cut costs, and ensure accurate, timely payments. With expert support, companies can focus on their core work while keeping AP efficient and compliant. Benefits include:

✅ Accurate handling of vendor and customer data for smooth payments

✅ Higher collection rates and less risk of bad debt

✅ Consistent ledger updates to meet GAAP standards

✅ Clear cash flow forecasts for better financial control

✅ Faster invoice processing with fewer errors, highlighting accounts payable benefits

Social Proof and Results: Success in Accounts Payable

IBN Technologies has played a key role in helping numerous businesses optimize their payable accounts operations:

• Clients report up to a 40% boosting cash flow management and speeding up payment cycles.

• Enhanced vendor relationships and lowered operational costs are realized through automated workflows and more efficient approval processes.

Next-Gen AP Outsourcing by IBN Technologies

As demand for Outsource Accounts Payable Services rises, businesses are increasingly turning to flexible, technology-driven solutions to maintain a competitive edge. The future of AP outsourcing will hinge on integrating advanced automation, stronger data security, and real-time analytics to enhance transparency and control. Companies adopting these innovations will be better positioned to navigate complex payment networks, adapt quickly to market shifts, and optimize cash flow while reducing operational risks.

In this evolving environment, providers like IBN Technologies deliver customized AP solutions that keep pace with changing regulations and industry needs. By helping businesses streamline operations and scale efficiently, these partnerships are transforming accounts payable processes from a routine task into a strategic asset that drives financial agility and sustainable growth. Their deep understanding of accounts payable process flow ensures seamless management and adaptation to new challenges.

Related Service:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release