FTAI Aviation Ltd. to Participate in the Barclays Americas Select Franchise Conference 2025

/EIN News/ -- NEW YORK, May 05, 2025 (GLOBE NEWSWIRE) -- FTAI Aviation Ltd. (NASDAQ:FTAI) (the “Company”) today announced that Joe Adams, Chief Executive Officer, will present at the Barclays Americas Select Franchise Conference 2025 at 10:15AM (ET) on Tuesday, May 6, 2025 in London.

As part of his presentation, Mr. Adams will discuss, among other items, the information in the below:

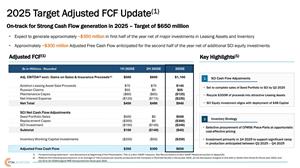

- A detailed walkthrough of FTAI’s outlook on Adjusted Free Cashflow for 2025.

- Expected uses of proceeds for excess cashflows generated throughout the year.

- FTAI’s pivot to an asset-light business model following the launch of the Strategic Capital Initiative.

A supplemental presentation relating to the Company’s Adjusted Free Cashflow for 2025 has been posted to the Investor Relations section of the Company’s website and the webcast will be broadcast live at https://ir.ftaiaviation.com/.

For definitions and reconciliations of non-GAAP measures, please refer to the exhibit to this press release. 2025 Adjusted EBITDA guidance reflects the following assumptions: (i) an average of 100 modules per quarter produced at the Company’s Montréal facility in fiscal year 2025, (ii) net Aerospace margins in line with or better than those for fiscal year 2024, and (iii) 25 to 35 V2500 engine MRE transactions for fiscal year 2025.

About FTAI Aviation Ltd.

FTAI owns and maintains commercial jet engines with a focus on CFM56 and V2500 engines. FTAI’s propriety portfolio of products, including the Module Factory and a joint venture to manufacture engine PMA, enables it to provide cost savings and flexibility to our airline, lessor, and maintenance, repair, and operations customer base. Additionally, FTAI owns and leases jet aircraft which often facilitates the acquisition of engines at attractive prices. FTAI invests in aviation assets and aerospace products that generate strong and stable cash flows with the potential for earnings growth and asset appreciation.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements related to the Company’s 2025 Adjusted EBITDA guidance and related assumptions, 2025 target Adjusted Free Cash Flow, completion of the sales of the Seed Portfolio to SCI and investments and returns in SCI, ability to recycle $300 million of proceeds into attractive Leasing assets, and ability to execute on inventory strategy. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, many of which are beyond the Company’s control. The Company can give no assurance that its expectations will be attained and such differences may be material. Accordingly, you should not place undue reliance on any forward-looking statements contained in this press release. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available on the Company’s website (www.ftaiaviation.com). In addition, new risks and uncertainties emerge from time to time, and it is not possible for the Company to predict or assess the impact of every factor that may cause its actual results to differ from those contained in any forward-looking statements. Such forward-looking statements speak only as of the date of this press release. The Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or change in events, conditions, or circumstances on which any statement is based. This release shall not constitute an offer to sell or the solicitation of an offer to buy any securities.

Contacts

Investors

Alan Andreini

Investor Relations

FTAI Aviation Ltd.

(646) 734-9414

aandreini@ftaiaviation.com

Media

Tim Lynch / Aaron Palash / Kelly Sullivan

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

Exhibit – Non-GAAP Financial Statements

This press release includes information based on financial measures that are not recognized under U.S. generally accepted accounting principles (GAAP), such as Adjusted EBITDA and Adjusted Free Cash Flow. You should use non‐GAAP information in addition to, and not as an alternative to, financial information prepared in accordance with GAAP. Our non-GAAP measures may not be identical or comparable to measures with the same name presented by other companies. Reconciliations of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures are not included in this press release because the most directly comparable GAAP financial measures are not available on a forward-looking basis without unreasonable effort.

Adjusted EBITDA is defined as net income (loss) attributable to shareholders, adjusted (a) to exclude the impact of provision for (benefit from) income taxes, equity-based compensation expense, acquisition and transaction expenses, losses on the modification or extinguishment of debt and preferred shares and capital lease obligations, changes in fair value of non-hedge derivative instruments, asset impairment charges, incentive allocations, depreciation and amortization expense, dividends on preferred shares and interest expense, internalization fee to affiliate, (b) to include the impact of our pro-rata share of Adjusted EBITDA from unconsolidated entities and (c) to exclude the impact of equity in earnings (losses) of unconsolidated entities and the non-controlling share of Adjusted EBITDA, if any.

Adjusted Free Cash Flow is defined as net operating and investing cashflows adjusted to exclude certain non-recurring expenses, extraordinary items, and other adjustments deemed necessary to present a more accurate reflection of the Company’s cash-generating ability.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b71a9094-6f2b-419a-8025-00497e5a3a91

Distribution channels: Banking, Finance & Investment Industry, Culture, Society & Lifestyle ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release