Eldorado Updates Lamaque Complex Technical Report; Demonstrating Significant Value and Potential to Extend Mine Life to 17 Years

(All dollar figures are in US dollars, unless otherwise stated)

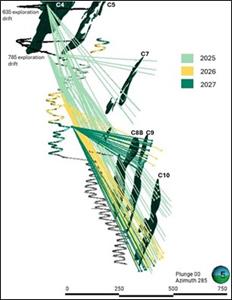

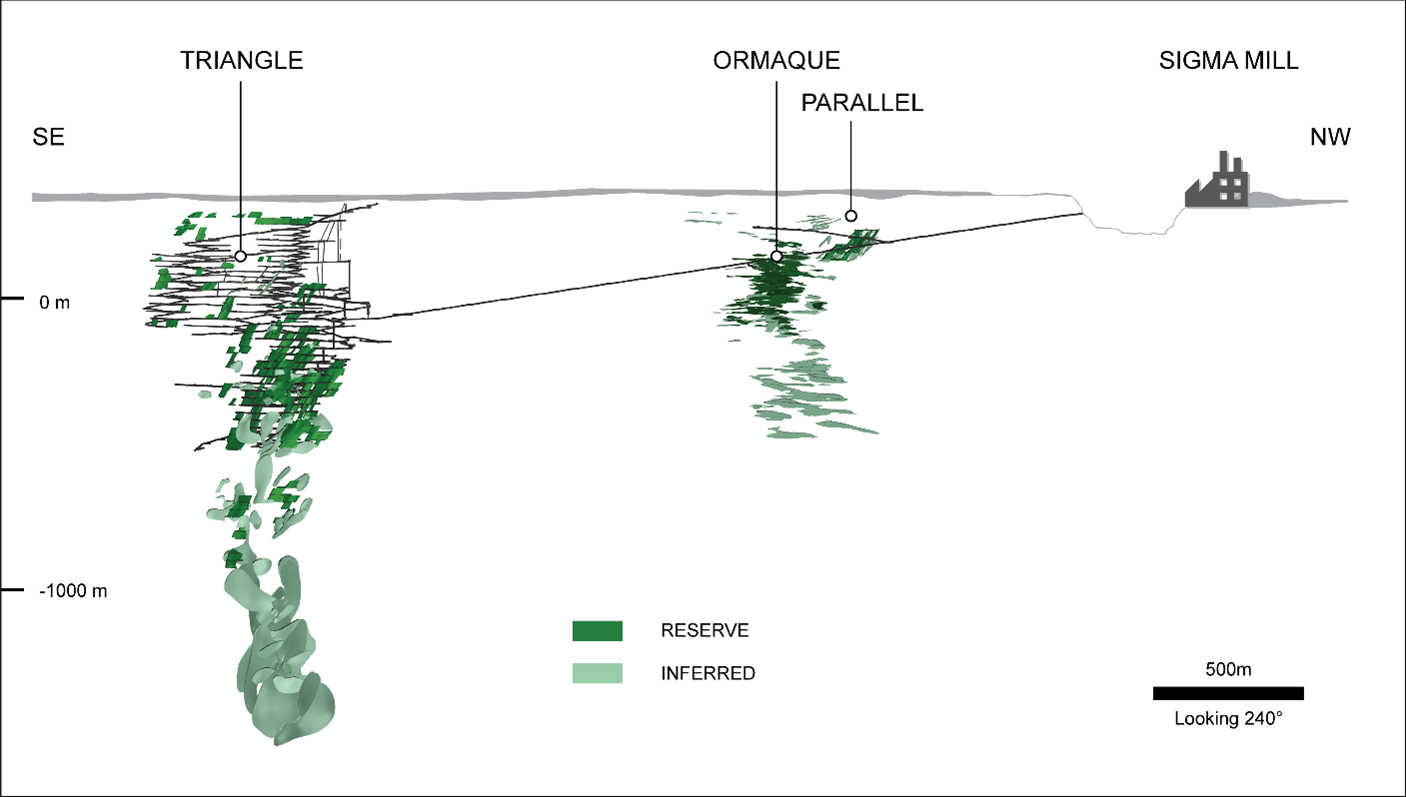

/EIN News/ -- VANCOUVER, British Columbia, Jan. 27, 2025 (GLOBE NEWSWIRE) -- Eldorado Gold Corporation (“Eldorado”, the “Company” or “We”) is pleased to announce the results of an updated Technical Report for the Lamaque Complex1 (“Lamaque Complex Technical Report”), including an updated life-of-mine (“LOM”) plan based on Mineral Reserves from Triangle, Ormaque and Parallel (the “Reserve Case”) and a Preliminary Economic Assessment (“PEA”) extended LOM plan primarily2 based on Inferred Mineral Resources (“Inferred Resources”) from Triangle and Ormaque (the “PEA Case”).

The Reserve Case outlines an 8-year mine life producing 1.2 million ounces of gold, while the PEA Case shows the potential to extend mine life incrementally by 9 years and incremental gold production of 1.5 million ounces. The Lamaque Complex Technical Report has been filed on SEDAR+.

Lamaque Complex Technical Report Highlights

Table 1 summarizes key metrics for the Reserve Case and PEA Case from the Lamaque Complex Technical Report which are based on the Mineral Reserve and Mineral Resource estimates that are shown in Appendix A.

Highlights of the Reserve Case

- Gold production of 1.2 million ounces over an 8-year mine life through 2032

- Average annual gold production above ~175,000 oz through 2028

- LOM All-In Sustaining Cost (“AISC”) of $1,176/oz Au3

- Solid economics with an:

- after-tax NPV(5%) of $555 million at a gold price of $2,000/oz

- after-tax NPV(5%) of $1.1 billion at a gold price of $2,600/oz

Highlights of the PEA Case

- Incremental gold production of 1.5 million ounces, showing the potential to extend mine life to 17 years through 2041

- Maintains average annual gold production of ~185,000 oz through 2036, providing a long runway for the Lamaque Complex and the Company’s overall business in Québec

- Maintains LOM AISC of $1,149/oz Au3

- Significant incremental economics highlight the long-term potential of the Lamaque Complex:

- after-tax NPV(5%) of $623 million at a gold price of $2,000/oz

- (for a total after-tax NPV(5%) of $1.2 billion when combined with the Reserve Case)

- after-tax NPV(5%) of $1.1 billion at a gold price of $2,600/oz Au

- (for a total after-tax NPV(5%) of $2.1 billion when combined with the Reserve Case)

- incremental IRR of the PEA case is 43.5% at a gold price of $2,000/oz Au

- 68.2% at a gold price of $2,600/oz Au

- 68.2% at a gold price of $2,600/oz Au

- after-tax NPV(5%) of $623 million at a gold price of $2,000/oz

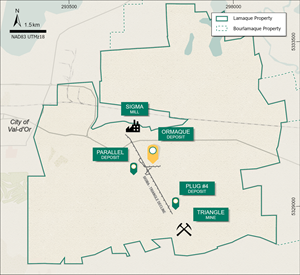

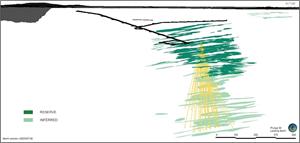

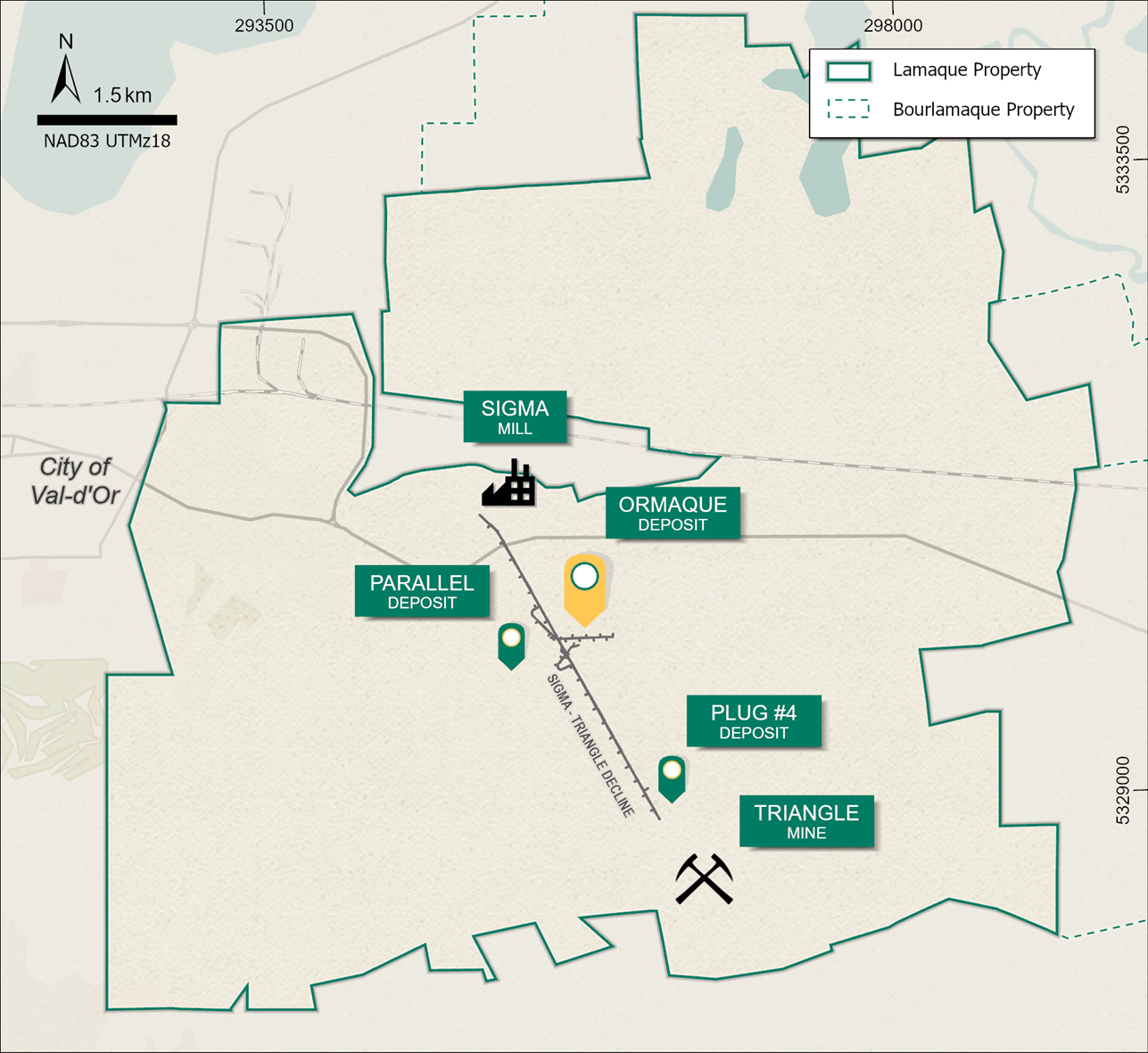

1 The Lamaque Complex includes the Triangle, Ormaque, Parallel and Plug No. 4 deposits, and the Sigma Mill (see Figure 2).

2 The PEA case includes a non-material amount of Measured and Indicated Mineral Resources (< 2%).

3 These are forward looking non-IFRS measures or ratios. Refer to the section “Forward-Looking Non-IFRS and Other Financial Measures and Ratios” for explanations and discussions of these non-IFRS financial measures or ratios.

The PEA Case is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves and there is no certainty that the forecast production amounts will be realized. The basis for the PEA and the qualifications and assumptions made by the qualified persons who undertook the PEA are set out in the advisories contained in this news release. The results of the PEA had no impact on the results of any prefeasibility or feasibility study in respect of the Lamaque Complex.

Maximizes installed capacity of plant and infrastructure with two mining centres. The installed capacity of the Sigma Mill, along with extensive infrastructure both on surface and underground, can be maximized with the addition of a paste plant and additional tailings capacity to bring the Ormaque deposit into production.

Strong collaboration and support from the Val-d’Or communities. We expect a transparent and predictable regulatory environment, reflective of Québec being a Tier 1 mining jurisdiction.

Significant exploration potential to grow Mineral Resources in existing deposits. The Ormaque deposit remains open at depth and laterally both in the upper and lower sections of the deposit. The Triangle deposit remains open at depth and we continue to drill Plug No. 4 and other advanced targets on the property.

Well-positioned with a large, under-explored land package in the Val d’Or area. The Company continues to assess exploration opportunities across the Lamaque Complex as well as its 100%-owned Bourlamaque property (contiguous to the Lamaque Complex) and in the wider Abitibi region.

“This marks another major milestone for the Lamaque Complex,” said George Burns, President and CEO. “After acquiring this asset in 2017, we successfully brought the Triangle deposit into commercial production in 2019, and it has since produced nearly one million ounces of gold. With the development of the Ormaque deposit, we will be adding a second underground mine to the Lamaque Complex, which provides operational flexibility and efficiency as we leverage the existing plant and infrastructure.

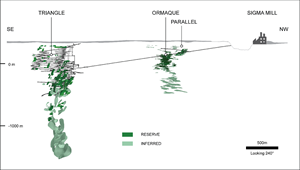

“Ormaque is located just off the existing Triangle–Sigma decline and was discovered through surface drilling in 2019 (see Figure 2 and Figure 3). An Inferred Mineral Resource was declared in February 2021 and an exploration drift was developed to allow underground conversion drilling of the upper sections of the deposit. A bulk sample of Ormaque material was processed at the Sigma Mill in December and preliminary results are in-line with expectations and support the current Ormaque Mineral Reserves and block model. The second phase of the bulk sample is expected for the second half of 2025, followed by an expected ramp-up phase beginning in 2026. We expect to reach full production in 2028.

“The Ormaque and Triangle deposits are located within the prolific Val-d’Or district of the Abitibi. This district hosts the historic Lamaque and Sigma Mines, which collectively produced nearly 10 million ounces of gold. Based on the existing resource base and favorable findings of the report, we maintain an optimistic view of the long-term potential at the Lamaque Complex.

“Our skilled and dedicated workforce, strategic position in the Abitibi region and collaborative relationships with First Nations and the local community, positions us to deliver sustainable, long-term benefits for the Val-d’Or region, while continuing to create value for our shareholders.”

Table 1: Key metrics based on the Lamaque Complex Technical Report

| Unit |

Reserve Case (includes Mineral Reserves only) |

PEA Case (includes Inferred Mineral Resources2 and is incremental to Reserve Case) |

|

| Production | |||

| Mine Life | yrs | 8 | 9 |

| Total Material Processed | Mt | 5.7 | 7.1 |

| Average Gold Grade | g/t | 6.55 | 6.78 |

| Total Gold Produced | koz | 1,168 | 1,500 |

| Operating Costs | |||

| Direct Operating Cost | $/t | 188 | 180 |

| Total Cash Cost3 | $/oz | 944 | 873 |

| AISC3 | $/oz | 1,176 | 1,156 |

| Capital Costs | |||

| Growth Capital Costs3 | US$M | 227 | 33 |

| Sustaining Capital Costs3 | US$M | 270 | 424 |

| Total Capital Cost | US$M | 497 | 457 |

| Economics @ $2,000/oz Au | |||

| LOM After-tax Cash Flow | US$M | 669 | 1,085 |

| After-tax NPV(5%) | US$M | 555 | 623 |

| IRR | % | n/a | 43.5 |

| Economics @ $2,600/oz Au | |||

| LOM After-tax Cash Flow | US$M | 1,257 | 1,788 |

| After-tax NPV(5%) | US$M | 1,064 | 1,059 |

| IRR | % | n/a | 68.2 |

2 The PEA case includes a non-material amount of Measured and Indicated Mineral Resources (< 2%).

3 These are forward looking non-IFRS measures or ratios. Refer to the section “Forward-Looking Non-IFRS and Other Financial Measures and Ratios” for explanations and discussions of these non-IFRS financial measures or ratios.

Figure 1: Lamaque Complex Production Profile (Reserve Case + PEA Case)

Figure 2: Lamaque Complex property map showing location of gold deposits and key infrastructure

Figure 3: Lamaque Complex long-section showing location of gold deposits and key infrastructure

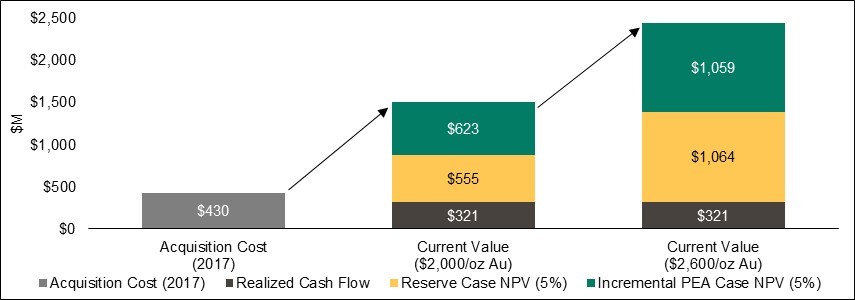

Significant Value Creation Since Acquisition

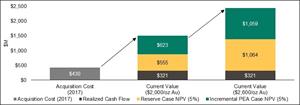

Eldorado acquired the Lamaque Complex in 2017 for total consideration of $430 million4. Since acquisition, it has generated over $3005 million of net cash flow and has been one of the Company’s most stable operations. Looking forward, we expect the Lamaque Complex to generate significant value and remain a cornerstone asset for the Company over the next decade and beyond. At a gold price of $2,000/oz, the Reserve Case generates an after-tax NPV5% of $555 million, while the PEA Case generates an incremental after-tax NPV5% of $623 million. At a gold price of $2,600/oz, the Reserve Case generates an after-tax NPV5% of $1.1 billion while the PEA Case generates an incremental after-tax NPV5% of $1.1 billion (see Figure 4).

Figure 4: Lamaque Complex track record of value creation since acquisition (US$ million)

4 Acquisition cost is based on headline transaction of C$590 million converted to USD at FX rate of 1.37.

5 Net cash flow generated from acquisition to December 31, 2024.

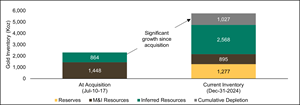

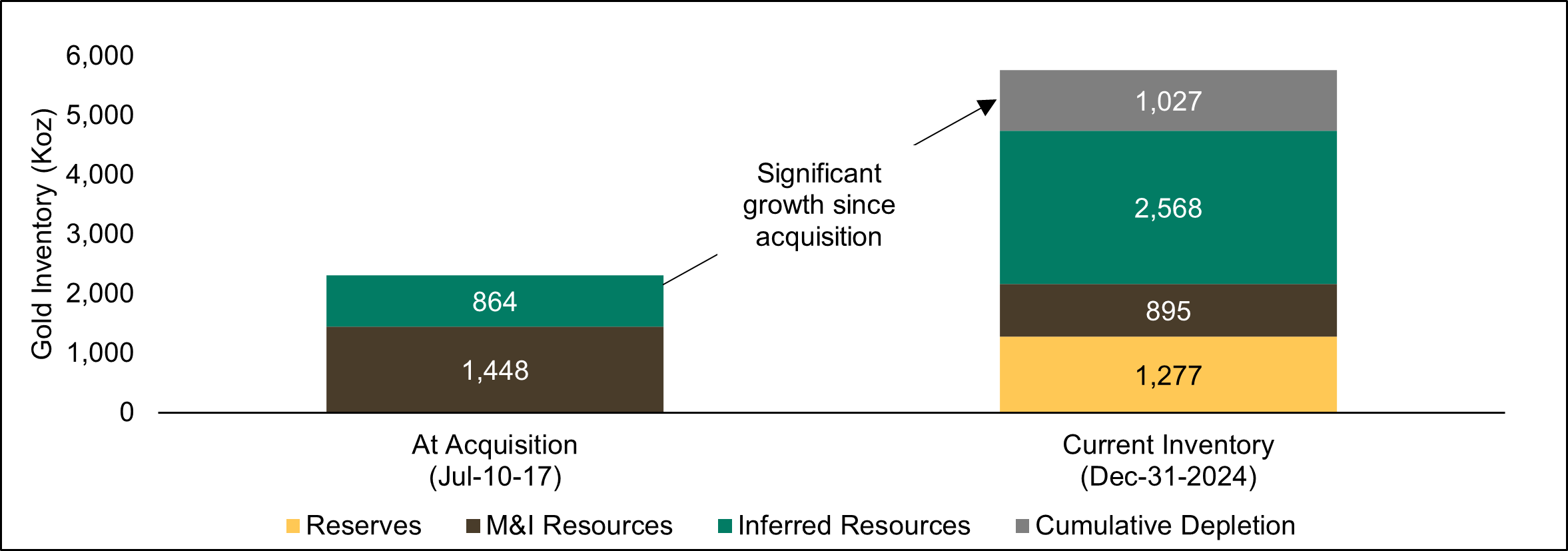

At the time of acquisition, the Lamaque Complex contained Measured and Indicated Mineral Resources (“M&I Resources”) of 1.4 million ounces of gold, Inferred Mineral Resources of 864,000 ounces of gold, and no Mineral Reserves. Since acquisition, the Lamaque Complex has produced nearly one million ounces of gold, while growing Mineral Reserves and Mineral Resources significantly (see Figure 5).

Figure 5: Lamaque Complex Mineral Reserve and Mineral Resource Growth since acquisition (koz Au)6,7

6 Depletion is based on contained gold processed as of December 31st, 2024.

7M&I Mineral Resources are exclusive of Mineral Reserves.

Lamaque Complex Planned Drilling and Regional Exploration

Exploration activities will continue at the Lamaque Complex, with a focus on resource conversion drilling at Lower Triangle, Ormaque and Plug No. 4, as well as testing for extensions at Ormaque and earlier stage targets close to Lamaque Complex infrastructure. Plans include:

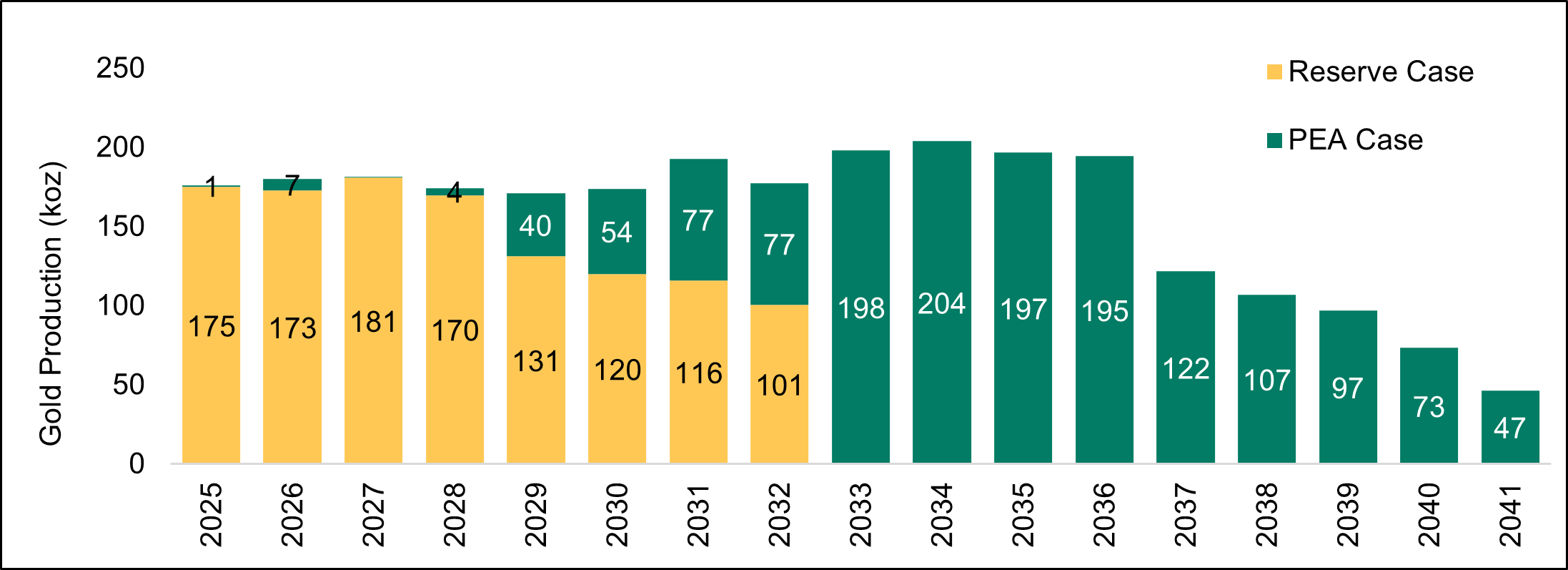

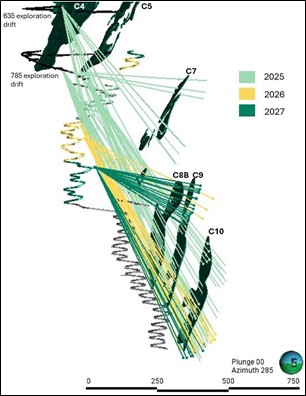

- Resource conversion drilling at Lower Triangle, where a multi-year plan has been developed to leverage access to drill platforms as underground infrastructure advances, while targeting deeper veins (C8 and below) with longer drill holes with the objective of reducing geological risk ahead of development (see Figure 6).

- Resource conversion drilling at Ormaque, where drilling during 2025 will focus on extending the core of the system at depth. Subsequent conversion drilling from 2026 onwards will be conditional upon ongoing exploration drilling that is testing lateral and depth extensions, and will prioritize domains of Inferred Mineral Resources that deliver maximum value for the operation (see Figure 7).

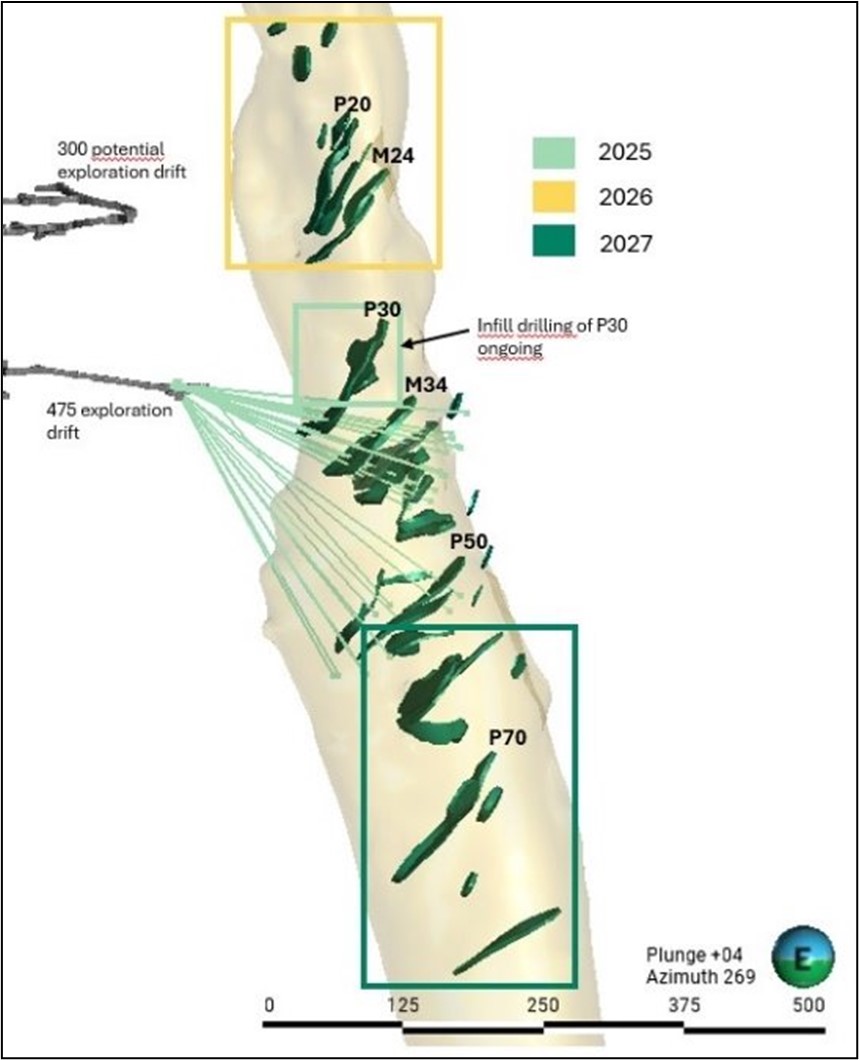

- Resource conversion drilling at Plug No. 4 will continue during 2025 from an exploration drift located off the Sigma-Triangle decline. Drilling will test the P30 to P50 veins, and conditional drilling is planned for 2026 and 2027 targeting shallower and deeper vein sets (see Figure 8).

- Surface drilling targeting additional Inferred Mineral Resources by testing lateral extensions of Ormaque, which remains open in all directions at various levels of the deposit, is planned through 2025.

- In addition, exploration drilling from surface and underground will also test earlier stage targets proximal to the Lamaque Complex infrastructure, including assessing the potential to extend known veins and testing new targets. In parallel, the Exploration team will continue to generate and drill test targets within the Eldorado land position in the wider district to assess future resource potential to feed the Sigma Mill.

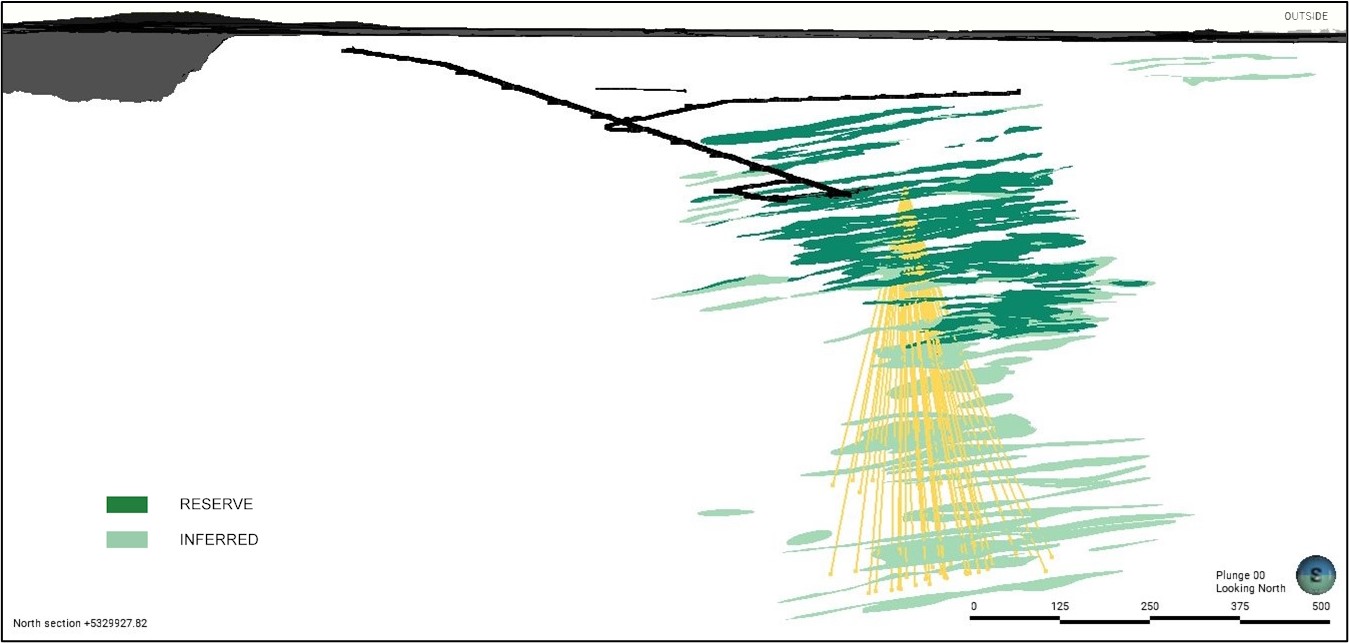

Figure 6 - Lower Triangle Mineral Resource conversion drilling (2025-2027)

Figure 7 - Ormaque Mineral Resource conversion drilling (2025)

Figure 8 – Plug No. 4 Mineral Resource conversion drilling (2025, with conditional 2026-2027 conceptual plan)

Interactive VRIFY 3D Model

To view an interactive 3D model that includes updated views of the Mineral Reserve and Mineral Resource shells use the following link: https://vrify.com/decks/17646?auth=80334cc6-3e93-4722-ac41-9313e4c8591a or visit Eldorado Gold's website: www.eldoradogold.com.

About Eldorado Gold

Eldorado is a gold and base metals producer with mining, development and exploration operations in Türkiye, Canada and Greece. The Company has a highly skilled and dedicated workforce, safe and responsible operations, a portfolio of high-quality assets, and long-term partnerships with local communities. Eldorado's common shares trade on the Toronto Stock Exchange (TSX: ELD) and the New York Stock Exchange (NYSE: EGO).

Contact

Investor Relations

Lynette Gould, VP, Investor Relations, Communications & External Affairs

647 271 2827 or 1 888 353 8166

lynette.gould@eldoradogold.com

Media

Chad Pederson, Director, Communications and Public Affairs

236 885 6251 or 1 888 353 8166

chad.pederson@eldoradogold.com

ADVISORIES AND DETAILED NOTES ON MINERAL RESERVES AND RESOURCES

General

Mineral Resources and Mineral Reserves are as of September 30, 2024.

The Mineral Resources and Mineral Reserves were classified using logic consistent with the CIM Definition Standards for Mineral Resources & Mineral Reserves (2014) incorporated, by reference, into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Sample preparation, analytical techniques, laboratories used, and quality assurance and quality control protocols used during exploration drilling programs are consistent with industry standards and independent certified assay labs are used.

Mineral Reserves are included in the Mineral Resources.

The Mineral Resources and Mineral Reserves are disclosed on a total project basis.

Measured and Indicated Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. With respect to “Inferred Mineral Resources”, there is a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of a “Measured Mineral Resource”, “Indicated Mineral Resource” or “Inferred Mineral Resource” will ever be upgraded to a higher category.

Additional information regarding the Lamaque Complex (which is considered to be a mineral property material to the Company) is contained in the Lamaque Complex Technical Report effective December 31, 2024 available under the Company's profile at www.sedarplus.com and at www.sec.gov.

Unless otherwise noted in this new release, Jessy Thelland, géo, Technical Services Director Lamaque at Eldorado Gold (Québec) Inc., who is a qualified person under NI 43-101, has approved all scientific and technical information in this news release.

Cautionary Note to US Investors Concerning Estimates of Measured, Indicated and Inferred Resources

There are differences between the standards and terms used for reporting mineral reserves and resources in Canada, and in the United States pursuant to the United States Securities and Exchange Commission’s (the “SEC”). The terms mineral resource, measured mineral resource, indicated mineral resource and inferred mineral resource are defined by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) and the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council, and must be disclosed according to Canadian securities regulations.

These standards differ from the requirements of the SEC applicable to domestic United States reporting companies. Accordingly, information contained in this news release with respect to mineral deposits may not be comparable to similar information made public by United States companies subject to the SEC’s reporting and disclosure requirements.

Mineral Reserve Notes

Eldorado reports Mineral Reserves in accordance with CIM Definition Standards. Mineral Reserves for the Lamaque Complex – Ormaque, Triangle and Parallel were determined using a long-term gold price of $1,450/oz. A reserve test is undertaken every year to confirm future undiscounted cash flow from reserve mine plan is positive.

-

Long-Term Metal Price Assumptions

- Gold price: $1,450/oz

- Silver price: $19.00/oz

- Copper price: $2.75/lb

- Lead price: $2,000/t

- Zinc price: $2,500/t

-

Cut-off Grades / Values

Lamaque Complex: 4.99 g/t (long hole stoping, Triangle and Parallel): 5.67 g/t (drift and fill, Ormaque) -

Qualified Persons

The following persons, all of whom are qualified persons under NI 43-101, have approved the disclosure relating to Mineral Reserves contained within this release:

| Asset | Mining Type(s) | Qualified Person | Company |

| Lamaque Complex: Triangle, Parallel, Plug No.4 |

Underground | Jessy Thelland, géo (OGQ No. 758) Technical Services Director Lamaque |

Eldorado Gold (Québec) Inc., as subsidiary of Eldorado Gold Corporation |

| Lamaque Complex: Ormaque |

Underground | Phillippe Groleau, Eng, (OIQ No. 5032770) Senior Strategic Planner |

Eldorado Gold (Québec) Inc., as subsidiary of Eldorado Gold Corporation |

Mineral Resource Notes

Eldorado reports Mineral Resources in accordance with CIM Definition Standards. All Mineral Resources are assessed for reasonable prospects for eventual economic extraction (RPEEE). The Resource cut-off grades or values (e.g. gold equivalent) are determined using a long-term gold price ($1,800/oz) and modifying factors derived in the resource to reserve conversion process (or by comparison to similar projects for our resource-only properties). These values are then used to create constraining volumes that provide limits to the reported Resources. Resource grades are reported undiluted from within the constraining volumes that satisfy RPEEE. Due to the presence of narrow veins, conversion of Resources to Reserves at Ormaque will reflect expected lower grades to fully represent modifying factors associated with mining.

Underground Resources were constrained by volumes whose design was guided by a combination of the reporting cut-off grade or value, contiguous areas of mineralization and mineability. Eldorado’s Mineral Resources are inclusive of Reserves.

-

Long-Term Metal Price Assumptions:

- Gold price: $1,800/oz

-

Mineral Resource Reporting and demonstration of Reasonable Prospects for Eventual Economic Extraction:

The Mineral Resources used a long term look gold metal price of $1,800/oz for the determination of resource cut-off grades or values. This guided execution of the next step where constraining surfaces or volumes were created to control resource reporting. Underground Resources were constrained by 3D volumes whose design was guided by the reporting cut-off grade or value, contiguous areas of mineralization and mineability. Only material internal to these volumes were eligible for reporting.

Cut-off Grades

Lamaque Complex (Triangle, Plug No. 4, Parallel and Ormaque): 3.5 g/t Au -

Qualified Persons

The following persons, all of whom are qualified persons under NI 43-101, have approved the disclosure regarding Mineral Resources contained within this release:

| Asset | Mining Type(s) | Qualified Person | Company |

| Lamaque Complex: Triangle, Parallel, Plug No. 4 | Underground | Jessy Thelland, géo (OGQ No. 758). Technical Services Director, Lamaque |

Eldorado Gold (Québec), Inc., as subsidiary of Eldorado Gold Corporation |

| Lamaque Complex: Ormaque | Underground | Jessy Thelland, géo (OGQ No. 758) Technical Services Director, Lamaque |

Eldorado Gold (Québec) Inc., as subsidiary of Eldorado Gold Corporation |

Notes on the PEA

Readers should take care to differentiate the PEA discussed in this news release from the economic analysis for the Lamaque Complex Mineral Reserves. The PEA only demonstrates the potential viability of Inferred Mineral Resources and is not as comprehensive as the economic analysis for the Lamaque Complex Mineral Reserves. The level of detail, precision and confidence in outcomes between the economic analysis for the Lamaque Complex Mineral Reserves and the Lamaque Complex Mineral Resources described in the PEA is significantly different.

The PEA is preliminary in nature and is based on numerous assumptions and the incorporation of Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves except as allowed for by National Instrument 43-101 in PEA studies. There is no guarantee that Inferred Mineral Resources can be converted to Indicated or Measured Mineral Resources and, as such, there is no guarantee that the economics described herein will be achieved. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The PEA Case is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves and there is no certainty that the forecast production amounts will be realized. The results of the PEA had no impact on the results of any prefeasibility or feasibility study in respect of the Lamaque Complex.

The Qualified Person made various assumptions in preparing the PEA, including the following: physical assumptions about mining dilution, rate of development, milling throughput and recovery rate (including mining rate decrease due to depth); future gold prices, exchange rates and energy costs; operating expenses including mining and processing costs; capital expenditures required to execute the incremental plan; continuation of existing mining methods, process plans and business operations; the Company's ability to obtain all required approvals and permits in a timely manner and its ability to comply with any associated conditions of those approvals and permits; and the future geopolitical, economic, permitting and legal climate applicable to the Lamaque Complex. For additional information, see the Lamaque Complex Technical Report effective December 31, 2024 available under the Company’s profile at www.sedarplus.com and at www.sec.gov.

Even though the Qualified Person believes that the assumptions made in preparing the PEA are reasonable, many assumptions may be difficult to predict and are beyond our control.

Forward-Looking Non-IFRS Financial Measures and Ratios

Certain non-IFRS forward-looking measures related to the Lamaque Complex, including total cash costs, all-in sustaining cost ("AISC"), growth capital costs, and sustaining capital costs are included in this news release. The Company believes that these measures and ratios, in addition to conventional measures and ratios prepared in accordance with International Financial Reporting Standards (“IFRS”), provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS and other financial measures and ratios are intended to provide additional information and should not be considered in isolation or as a substitute for measures or ratios of performance prepared in accordance with IFRS. These measures and ratios do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

With respect to the non-IFRS measures disclosed in this news release, the Company defines them as follows:

Total Cash Costs

We define total cash costs following the recommendations of the Gold Institute Production Cost Standard. The production cost standard developed by the Gold Institute remains the generally accepted standard of reporting total cash costs of production by gold mining companies. Total cash costs include direct operating costs (including mining, processing and administration), refining and selling costs (including treatment, refining and transportation charges and other concentrate deductions), and royalty payments, but exclude depreciation and amortization, share based payments expenses and reclamation costs. Revenue from sales of by-products including silver, lead and zinc reduce total cash costs.

All-In Sustaining Costs (AISC)

We define AISC based on the definition set out by the World Gold Council, including the updated guidance note dated November 14, 2018. We define AISC as the sum of total cash costs (as defined above), sustaining capital expenditure relating to current operations (including capitalized stripping and underground mine development), sustaining leases (cash basis), sustaining exploration and evaluation cost related to current operations (including sustaining capitalized evaluation costs), reclamation cost accretion and amortization related to current gold operations and corporate and allocated general and administrative expenses. Corporate and allocated general and administrative expenses include general and administrative expenses, share-based payments and defined benefit pension plan expense. Corporate and allocated general and administrative expenses do not include non-cash depreciation. As this measure seeks to reflect the full cost of gold production from current operations, growth capital and reclamation cost accretion not related to operating gold mines are excluded. Certain other cash expenditures, including tax payments, financing charges (including capitalized interest), except for financing charges related to leasing arrangements, and costs related to business combinations, asset acquisitions and asset disposals are also excluded.

Sustaining Capital

Sustaining capital is capital required to maintain current operations at existing levels, including capitalized stripping and underground mine development. Sustaining capital excludes non-cash sustaining lease additions, unless otherwise noted, and does not include capitalized interest, expenditure related to development projects, or other growth or sustaining capital not related to operating gold mines.

Growth Capital

Growth capital is capital investment for new operations, major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

Our September 30, 2024 Management’s Discussion & Analysis (“MD&A”), available on SEDAR+ at www.sedarplus.com and on the Company's website under the 'Investors' section, contains explanations and discussions of historic total cash costs., AISC, sustaining capital and growth capital for the Lamaque Complex for the three and nine months ended September 30, 2024, as well as the comparable measures as at September 30, 2023. For a discussion of the composition and usefulness of certain of these non-IFRS measures and a reconciliation of these historical measures to production costs, see specifically "Non-IFRS and Other Financial Measures and Ratios" in the Company’s Management Discussion & Analysis for the periods ended December 31, 2023 and September 30, 2024.

Our September 30, 2024, MD&A discloses the following with respect to the Lamaque Complex:

| Three months ended Sept 30/24 | Three months ended Sept 30/23 | Nine months ended Sept 30/24 | Nine months ended Sept 30/23 | |

| Total cash costs ($/oz sold) | 728 | 648 | 755 | 697 |

| AISC ($/oz sold) | 1,189 | 1,099 | 1,228 | 1,143 |

| Sustaining Capital ($M) | 20.4 | 18.3 | 62.3 | 52.9 |

| Growth Capital ($M) | 6.4 | 8.2 | 18.9 | 15.3 |

The forward-looking total cash costs, AISC, sustaining capital and growth capital disclosed in this news release have been calculated consistent with both the methodology noted above and the methodology underpinning the disclosures in the September 30, 2024 MD&A (that is, there are no significant differences in methodology between the historic and forward-looking non-IFRS measures).

Cautionary Note about Forward-Looking Statements and Information

Certain of the statements made and information provided in this press release are forward-looking statements or information within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. Often, these forward-looking statements and forward-looking information can be identified by the use of words such as “anticipates”, “believes”, “budget”, “continue”, “estimates”, “expects”, “forecasts”, “guidance”, “intends”, “plans”, “projected” or “scheduled” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements or information contained in this release include, but are not limited to, statements or information with respect to the expectations regarding the Reserve Case and the PEA Case for the Lamaque Complex, including gold production, costs and economics, including assumptions used to determine the Reserve Case and the PEA Case; intentions to mine the Ormaque deposit, including the expected mining techniques, the capacity of the Sigma Mill, and leveraging of existing infrastructure and development of additional infrastructure; potential exploration activities and 2025 plans to develop another underground exploration drift and to continue conversion drilling; the second phase of the bulk sample of Ormaque and the timing thereof, including permitting, and its expected ramp-up and full production; mineral reserves and mineral resources, including specific metrics and mine plans related thereto; future gold price assumptions; future infrastructure plans; exploration opportunities including evaluation of near mine targets; and generally long term views, strategy and plans related to the Lamaque Complex and its impact, including regarding support of the relevant communities.

Forward-looking statements and forward-looking information by their nature are based on assumptions and involve known and unknown risks, market uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

We have made certain assumptions about the forward-looking statements and information, including assumptions about: our ability to execute our planned mining activities at the Lamaque Complex, including development of another underground exploration draft, and drilling; our ability to obtain all required approvals and permits in a timely manner and our ability to comply with all the conditions that are imposed in such approvals and permits; timing, cost and results of our construction and development activities, improvements and exploration; the future price of gold and other commodities and the global concentrate market; exchange rates; anticipated values, costs, expenses and working capital requirements; production and metallurgical recoveries; mineral reserves and resources; our ability to unlock the potential of our property portfolio; our ability to address the negative impacts of climate change and adverse weather; the cost of, and extent to which we use, essential consumables (including fuel, explosives, and cement) ; the impact and effectiveness of productivity initiatives; the time and cost necessary for anticipated overhauls of equipment; the use, and impact or effectiveness, of growth capital; the impact of acquisitions, dispositions, suspensions or delays on our business; the sustaining capital required for various projects; and the geopolitical, economic, permitting and legal climate that we operate in. In addition, except where otherwise stated, we have assumed a continuation of existing business operations on substantially the same basis as exists at the time of this release.

Even though our management believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that the forward-looking statement or information will prove to be accurate. Many assumptions may be difficult to predict and are beyond our control.

Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. These risks, uncertainties and other factors include, among others, risks relating to our operations; community relations and social license; liquidity and financing risks; climate change; inflation risk; environmental matters; production and processing; waste disposal; geotechnical and hydrogeological conditions or failures; the global economic environment; risks relating to any pandemic, epidemic, endemic or similar public health threats; reliance on a limited number of smelters and off-takers; labour (including in relation to employee/union relations, employee misconduct, key personnel, skilled workforce, and contractors); indebtedness (including current and future operating restrictions, implications of a change of control, ability to meet debt service obligations, the implications of defaulting on obligations and change in credit ratings); government regulation; the Sarbanes-Oxley Act; commodity price risk; mineral tenure; permits; risks relating to environmental sustainability and governance practices and performance; financial reporting (including relating to the carrying value of our assets and changes in reporting standards); non-governmental organizations; corruption, bribery and sanctions; information and operational technology systems; litigation and contracts; estimation of mineral reserves and mineral resources; different standards used to prepare and report mineral reserves and mineral resources; credit risk; price volatility, volume fluctuations and dilution risk in respect of our shares; actions of activist shareholders; reliance on infrastructure, commodities and consumables (including power and water); currency risk; interest rate risk; tax matters; dividends; reclamation and long-term obligations; acquisitions, including integration risks, and dispositions; regulated substances; necessary equipment; co-ownership of our properties; the unavailability of insurance; conflicts of interest; compliance with privacy legislation; reputational issues; competition. as well as those risk factors discussed in the sections titled “Forward-looking information and risks” and “Risk factors in our business” in our most recent Annual Information Form & Form 40-F. The reader is directed to carefully review the detailed risk discussion in our most recent Annual Information Form & Form 40-F filed on SEDAR+ and EDGAR under our Company name, which discussion is incorporated by reference in this release, for a fuller understanding of the risks and uncertainties that affect our business and operations.

The inclusion of forward-looking statements and information is designed to help you understand management’s current views of our near- and longer-term prospects, and it may not be appropriate for other purposes.

There can be no assurance that forward-looking statements or information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, you should not place undue reliance on the forward-looking statements or information contained herein. Except as required by law, we do not expect to update forward-looking statements and information continually as conditions change and you are referred to the full discussion of the Company’s business contained in the Company’s reports filed with the securities regulatory authorities in Canada and the U.S.

APPENDIX A – Mineral Reserves and Mineral Resources

Table 2: Lamaque Complex Mineral Reserves as of September 30, 20241

| Proven Mineral Reserves | Probable Mineral Reserves | Proven & Probable Mineral Reserves | |||||||

| Tonnes | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | |

| (x1000) | g/t | ounces (x 1000) | (x1000) | g/t | ounces (x 1000) | (x1000) | g/t | ounces (x 1000) | |

| Triangle, Parallel | 1,357 | 5.70 | 249 | 1,956 | 6.50 | 409 | 3,313 | 6.19 | 658 |

| Ormaque | 3 | 7.76 | 1 | 2,661 | 7.22 | 618 | 2,664 | 7.22 | 619 |

| Total | 1,360 | 5.72 | 250 | 4,617 | 6.92 | 1,027 | 5,977 | 6.65 | 1,277 |

1Values may not sum due to rounding. Mineral Resources are inclusive of Mineral Reserves.

Table 3: Lamaque Complex Mineral Resources as of September 30, 20241

| Measured Mineral Resources | Indicated Mineral Resources | M&I Mineral Resources | Inferred Mineral Resources | |||||||||

| Tonnes | Grade | Contained | Tonne | Grade | Contained | Tonnes | Grade | Contained | Tonnes | Grade | Contained | |

| (x1000) | g/t | oz (x 1000) | (x1000) | g/t | oz (x 1000) | (x1000) | g/t | oz (x 1000) | (x1000) | g/t | oz (x 1000) | |

| Triangle, Plug No. 4, Parallel | 2,269 | 6.55 | 477 | 4,367 | 6.74 | 947 | 6,636 | 6.67 | 1,424 | 8,188 | 6.58 | 1,731 |

| Ormaque | 3 | 7.76 | 1 | 1,414 | 16.44 | 747 | 1,417 | 16.41 | 748 | 1,750 | 14.87 | 837 |

| Total | 2,272 | 6.55 | 478 | 5,781 | 9.12 | 1,694 | 8,053 | 8.39 | 2,172 | 9,938 | 8.04 | 2,568 |

1Values may not sum due to rounding.

For further information including the ‘Advisories and Detailed Notes on Mineral Reserves and Resources’ please see the news release dated December 11, 2024 titled ‘Eldorado Gold Releases Updated Mineral Reserve and Mineral Resource Statement; 2024 Gold Mineral Reserves Increased to 11.9 Million Oz with M&I Gold Mineral Resources of 22.0 Million Oz; Inaugural Mineral Reserve Declared at Ormaque; Outline of 2025 Reporting Schedule.’

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/452691fc-7c53-4c97-97a5-3d20c146e4a7

https://www.globenewswire.com/NewsRoom/AttachmentNg/8058066e-4ef0-4480-adfd-85927ceeb1ef

https://www.globenewswire.com/NewsRoom/AttachmentNg/d286f7b3-7cdd-494f-b616-dab76b5242dd

https://www.globenewswire.com/NewsRoom/AttachmentNg/b3e709e5-e485-4913-862b-af0a77d83bd1

https://www.globenewswire.com/NewsRoom/AttachmentNg/f8df9876-710a-4024-9d95-cc4ce2f52ce7

https://www.globenewswire.com/NewsRoom/AttachmentNg/af50acab-a22a-4699-b693-fc910aada8c0

https://www.globenewswire.com/NewsRoom/AttachmentNg/eaf06afb-bf0a-404c-af19-d506788cf5fd

https://www.globenewswire.com/NewsRoom/AttachmentNg/19fe21c9-79ff-4dfc-a4c7-16ddb7b148bf

Figure 1

Lamaque Complex Production Profile (Reserve Case + PEA Case)

Figure 2

Lamaque Complex property map showing location of gold deposits and key infrastructure

Figure 3

Lamaque Complex long-section showing location of gold deposits and key infrastructure

Figure 4

Lamaque Complex track record of value creation since acquisition (US$ million)

Figure 5

Lamaque Complex track record of Mineral Reserve and Mineral Resource Growth since acquisition (Koz Au)5

Figure 6

Lower Triangle resource conversion drilling (2025-2027)

Figure 7

Ormaque resource conversion drilling (2025)

Figure 8

Plug No. 4 resource conversion drilling (2025, with conditional 2026-2027 conceptual plan)

Distribution channels: Banking, Finance & Investment Industry, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release